True An insured claimant has a duty to notify the title insurance company of any title defects that may result in a claim under the insurance. If a valid claim is filed your Owners Policy subject to its terms and conditions will cover.

Parts Of A Title Policy Home Closing 101

Title insurance policies also cover the cost of resolving also known as curing most title problems also known as defects uncovered during the title search.

. A broker handling an escrow is subject to disciplinary action if. However title insurance does not cover everything. The standard exceptions to coverage found in owner title insurance policies include the following.

The person who examines the chain of title and prepare an opinion of title for a parcel of real estate A. A standard title insurance policy ordinarily. Common defects include but are not.

Writes a brief history y of the record of ownership of the property. A standard title insurance policy will protect the insured against all of the following except. A title plant is a.

Thus a new lenders policy for title is required. The purpose of the procedure is to discover any liens imposed on the property that would prevent the owner from selling it. Inspects the physical condition of the property.

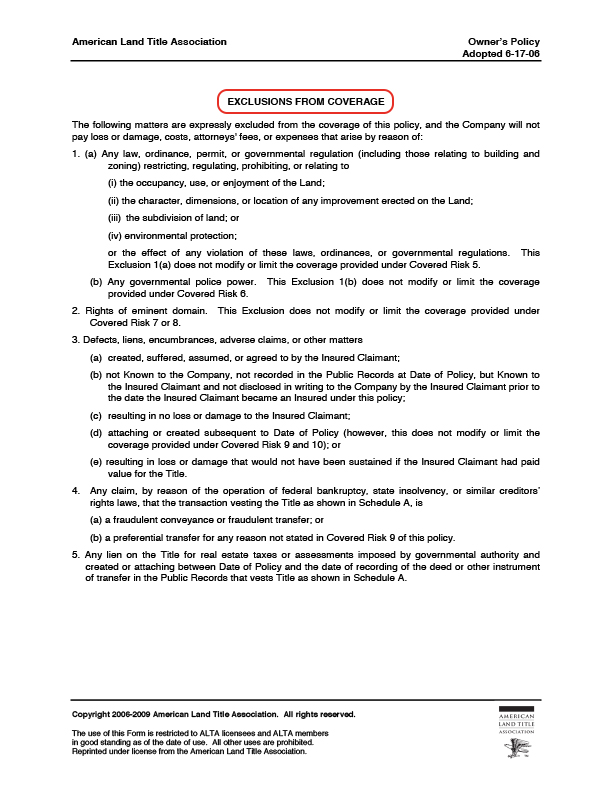

An owners title insurance policy excludes from coverage defects liens encumbrances and adverse claims created by the insured claimant. In this article we are going to talk about the things that your owners title insurance policy does not cover. Standard coverage in an owners title insurance policy would cover all of the following EXCEPT A incompetent grantors B defects found in public records C forged documents D changes in land use brought about by zoning ordinances.

Owner policies provide a huge umbrella of coverage against many issues that can arise from a person owning land or property. Ensures the condition of the title. When a home is refinanced the life of one loan ends and another begins.

A homeowners standard policy of title insurance covers all EXCEPT. A homes insurance policy typically covers four types of occurrences that occur on. C a lack of capacity.

With those policies you buy protection for events that may happen in the future. It can be paid for by the seller at closing so you may want to negotiate for it when you are purchasing a home. It protects you from someone challenging your ownership of a property because of an event involving a previous owner.

A title search also ensures that the property being sold is the sellers. You are covered as long as you have an ownership interest in the home You never have to buy it again. Owners title insurance is a policy on the deed of your home.

Some of the benefits of having title insurance is that it protects you against false impersonation of the true property owner forged deeds or wills undisclosed heirs to the property any mistakes made in recording legal documents and liens. There are two basic types of policies that provide title insurance coverage to owners of real property. When you purchase your home you receive a document most often called a deed which shows the seller transferred their legal ownership or title to their home to you.

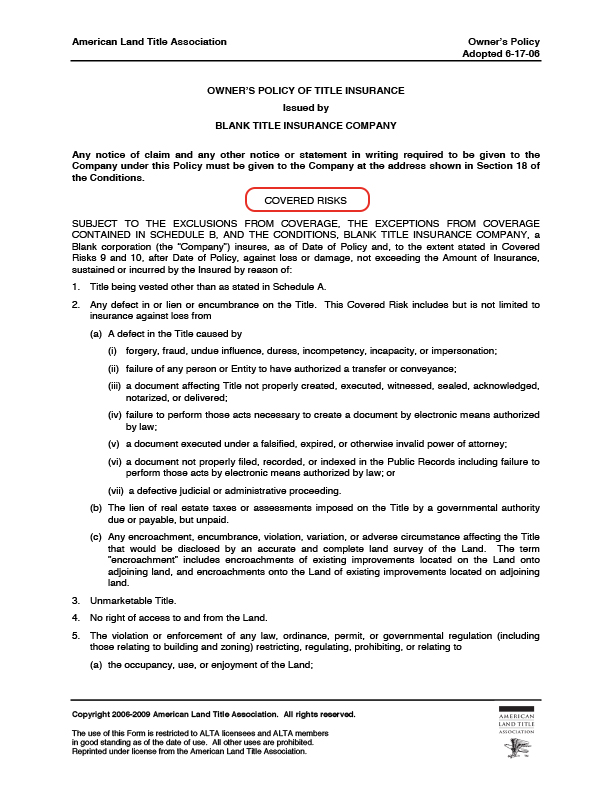

Issues a guarantee as to the quality of the title. Four basic insuring provisions of an ALTA owners policy 1 insurance that title to the estate or interest described in schedule a is vested in the insured 2 insurance against any defect lien or encumberance on such title 3 insurance that the title is marketable title and 4 insurance that the property has access to public road. Owners Title Insurance is a policy that protects you in case someone tries to make a claim on the property you purchased.

You are covered up to 150 of the purchase price so as your homes value increases it is covered. That are promulgated by federal state and local jurisdictions. The claim on your deed or the document showing the property was transferred to you can be anything from previous owners who owe taxes to unknown heirs.

A a mining clause. Owners title insurance covers you against title claims due to PAST and FUTURE title defects that surface. Because an owners policy provides coverage generally for as long as you or your heirs hold an interest in the property there is no need to purchase a new owners policy when refinancing.

The Owners Policy has its origins in a form of policy adopted by the American Land Title Association in 1970 and revised in 1984 and 1992. The owners title policy is designed to protect the homeowner in case of any claims against their ownership of the home. An Owners Title Policy is designed to protect you from covered title defects that existed prior to the issue date of your policy.

It is meant to protect you in case this arises. Whats Owners Title Insurance. Ownership by another party Incorrect signatures on documents as well as forgery and fraud.

A there is a charge for the escrow. A a mining clause. Owners title insurance provides protection to the homeowner if someone sues and says they have a claim against the home from before the homeowner purchased it.

D undisclosed spousal interest. In most cases owners title insurance is not required in a home purchase but it is recommended. An owners policy of title insurance is essential to cover your investment from potential future claims.

Protects only the party named as the insured party in the written policy. Collection of real estate records. The ALTA 2006 Owners Policy with standard coverage.

The following are the most popular ways to pay for PMI. What Title Insurance Covers. A basic owners title insurance policy typically covers the following hazards.

The present version of the policy was adopted on June 17 2006 by the American Land Title Association after extensive revisions suggested by real estate professionals in the industry and its partners. Governmental Regulations Zoning water rights mineral rights etc. The ALTA 2006 Owners Policy with Standard coverage and the ALTA 1987 Residential Owners Policy with Owners Extended coverage OEC for short or Plain Language coverage.

This is not like your home or auto insurance coverage. Title insurance can protect you.

Parts Of A Title Policy Home Closing 101

The Smart Trick Of Title Insurance And Why You Need It That Nobody Is Discussing Boat Booker

Parts Of A Title Policy Home Closing 101

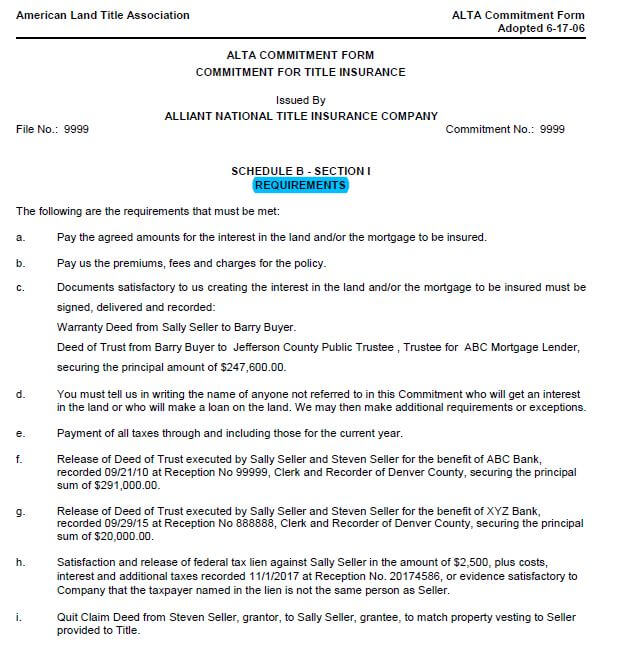

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

0 Comments